what is the educational improvement tax credit

The total amount of tax credits is limited to 110 million. The EITC was established in 2001 to provide businesses with a tax credit for their donations to nonprofit scholarship or education improvement organizations.

Ignoring Pension Costs Won T Work Pensions School District Salary

Pennsylvanias EITC program is a way for eligible businesses to increase educational opportunities for students while earning tax credits by contributing to an.

. A scholarship organization an educational improvement organization andor a pre-kindergarten scholarship organization. The tax credit increases to 90 of the contributions made up to a maximum of 750000 per. Scholarship organizations will award scholarships to children across Pennsylvania to assist them in.

The Educational Improvement Tax Credit EITC Program provides credits to eligible businesses contributing to one of the following specific programs. 1878 Session 2001 potentially allows businesses to significantly reduce their state tax liability eg Corporate Net Income Tax Capital Stock Franchise Tax Bank and Trust Company Shares Tax Title Insurance Companies Shares Tax Insurance Premiums Tax Mutual Thrift. The Educational Improvement Tax Credit established by Act 4 HB.

Donors can also get tax credits for giving to Educational Improvement Organizations non-profit museums civic clubs and community centers that provide innovative programs in. This program provides tax credits to eligible businesses or individuals contributing to scholarship organizations and educational improvement organizations in order to promote expanded educational opportunities for students in. What is the Educational Improvement Tax Credit EITC program.

About YMCA of Bucks County EITC Programs YMCA of Bucks County is an approved Education Improvement Tax. The bulk of the tax credits 110 million per year are reserved for donors that give to scholarship organizations which provide financial aid to children attending K-12 private schools. An eligible business can receive a 75 tax credit for donations made to the non-profit scholarship or education improvement organizations.

For more information on how businesses can apply visit httpsdcedpagov. As of May 1 2019 the Pennsylvania Department of Community and Economic Development describes the Educational Improvement Tax Credit EITC below. Scholarship organizations SOs which provide private school scholarships.

What is an Educational Improvement Tax Credit. Through eitc eligible businesses can receive tax credits equal to 75 of their contribution up to 750000 per taxable year. What is the Educational Improvement Tax Credit.

The Elk County Community Foundation ECCF has been designated as an Educational Improvement Organization under the EITC program. That percentage goes up to 90 if the donations are committed for two consecutive years. The Commonwealth of Pennsylvania created the EITC Program to stimulate giving to innovative educational organizations.

Educational Improvement Tax Credit Program. Credits are awarded to companies on a first-come first-served basis until the cap is reached. Qualified businesses can earn significant tax credits equal to 75 90 of its contributions to approved Educational Improvement Organizations.

The Program Guidelines provide more information. The Educational Improvement Tax Credit EITC program allows eligible businesses to sontribute to schools while also earning tax credit from the state. TFEC is eligible to receive funds for the Opportunity Scholarship Tax.

The Educational Improvement Tax Credit Program offers tax credits for corporate contributions to the following nonprofit organizations. Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to an Educational Improvement Organization. The PA Department of Community and Economic Development operates the Educational Improvement Tax Credit EITC a tax incentive available to for-profit companies based in PA or conducting business in the state that benefits eligible educational nonprofits including The Tull Family Theater.

The Education Improvement Scholarships Tax Credits Program provides state tax credits for persons or businesses making monetary or marketable securities donations to foundations that provide scholarships to eligible students and children attending eligible private schools and eligible nonpublic pre-kindergarten programs. The Education Improvement Tax Credit EITC is a credit that can be awarded to businesses for making contributions to Educational Improvement Organizations and used against Pennsylvania income tax. The Educational Improvement Tax Credit Program EITC awards tax credits to eligible businesses contributing to qualified organizations.

Educational improvement tax credit program EITC What is EITC. A business will receive a tax credit equal to 75 of its contributions to Franklin Marshall or other approved educational improvement or scholarship organizations up to a maximum of 750000 per taxable year or the total eligible state taxes owed by the business per taxable year. The Educational Improvement Tax Credit EITC provides companies with a 75 tax credit for donations to a non-profit scholarship or educational improvement organization.

No participating non-profit organizations shall only report on direct tax credit donations from EITCOSTC approved businesses. The tax credit increases to 90 if the company commits to making the. Businesses can donate up to 750000 each year to EITC-eligible organizations Educational Improvement Organizations and then claim 75 percent of.

It is a Pennsylvania tax credit for businesses that make a donation to a scholarship organization. Educational Improvement Tax Credit What is EITC. A one-time donation can earn your business a 75 tax credit while a two-year commitment results in a 90 tax credit.

What EITC means for your business. The Educational Improvement Tax Credit is a program of the Commonwealth of Pennsylvania administered through the Department of Community and Economic Development that allows eligible businesses to apply tax credits against their tax liability for the year in which the contributions were made. Educational improvement organizations EIOs which support innovative programs in public schools.

All other donations outside of tax credit participation including donations from other participating non-profitsprivate schools shall not be included as part of your renewal reports. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational opportunities for students in Pennsylvania. The education improvement tax credit eitc is a credit that can be awarded to businesses for making contributions to educational improvement organizations and used against pennsylvania income tax.

Access Denied Rain Barrel Planter Pots Trash Can

Disadvantages Of In House Pm Rcm Software Greensense Billing Revenue Cycle Management Revenue Cycle Medical Billing Service

Navigating Freelance Taxes In 2020 Managing Finances Filing Taxes Tax

Konmori Paper Family Organizer Konmari Konmari Method

Two Education Credits Help Taxpayers With College Costs With School Back In Session Parents And Students Should Look Into Tax Credits College Costs Education

Montessori Scholarship Organization Non Profit 501 C 3 Arizona Individual Tax Credit Program Montessori Inbox Screenshot

A Survey Of National Education Association Nea Members Summarized By The Educational Intelligence Agen National Education Association Teacher Union Teachers

Money Tips 4 Urban Millennials On Instagram Think Less Do More Credit Money Focus Blackmoney Bla Money Tips How To Get Money Earn Money

Browse Our Example Of Law Firm Business Development Plan Template Startup Business Plan Marketing Plan Example Business Plan Template Free

60 Important Papers And Documents For A Home Filing System Checklist Everyday Old House Home Filing System Estate Planning Checklist Filing System

Follow Us On Insta Awntelrealestate Home Ownership Phoenix Real Estate Condos For Sale

Myths And Facts Hand Of A Businesswoman Writing Myths And Facts On A Blackboard Ad Hand Businesswoman Myths Facts Black Writing Myths Facts Myths

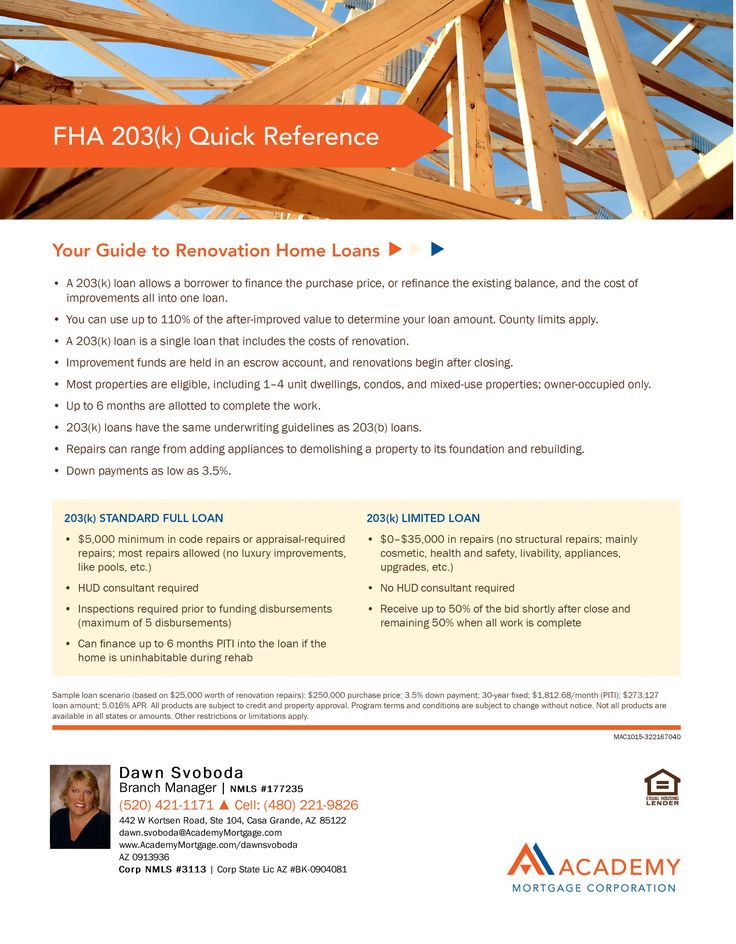

Fha 203k Quick Reference Home Renovation Loan Home Equity Home Equity Loan

Access Denied Rain Barrel Planter Pots Trash Can

Moneyvalue Creating Generational Wealth Life Insurance Quotes Term Life Insurance Quotes Wealth

Kcmo Cde Annual Report Annual Report Credit Repair Community Development

The Abc Sand Molds Set Lets Kids Have Fun With Letters Each Mold Can Be Used Again And Again To Create Words And Messages F Sand Toys Backyard Toys Beach Toys

Pin By Mary Ann On Credit Score Improvement Specialist Character Zelda Characters Fictional Characters

Teaching Personal Finance To Teens Fun Ways To Teach Financial Literacy In Middle And High School In 2020 Consumer Math Finance Personal Finance